arizona vs nevada retirement taxes

The biggest advantage is low taxes and many might also like the weather the abundance of things to do and the many retirement communities. Lets assume youre 65 years of age earning 60000 a year.

The States With The Highest Capital Gains Tax Rates The Motley Fool

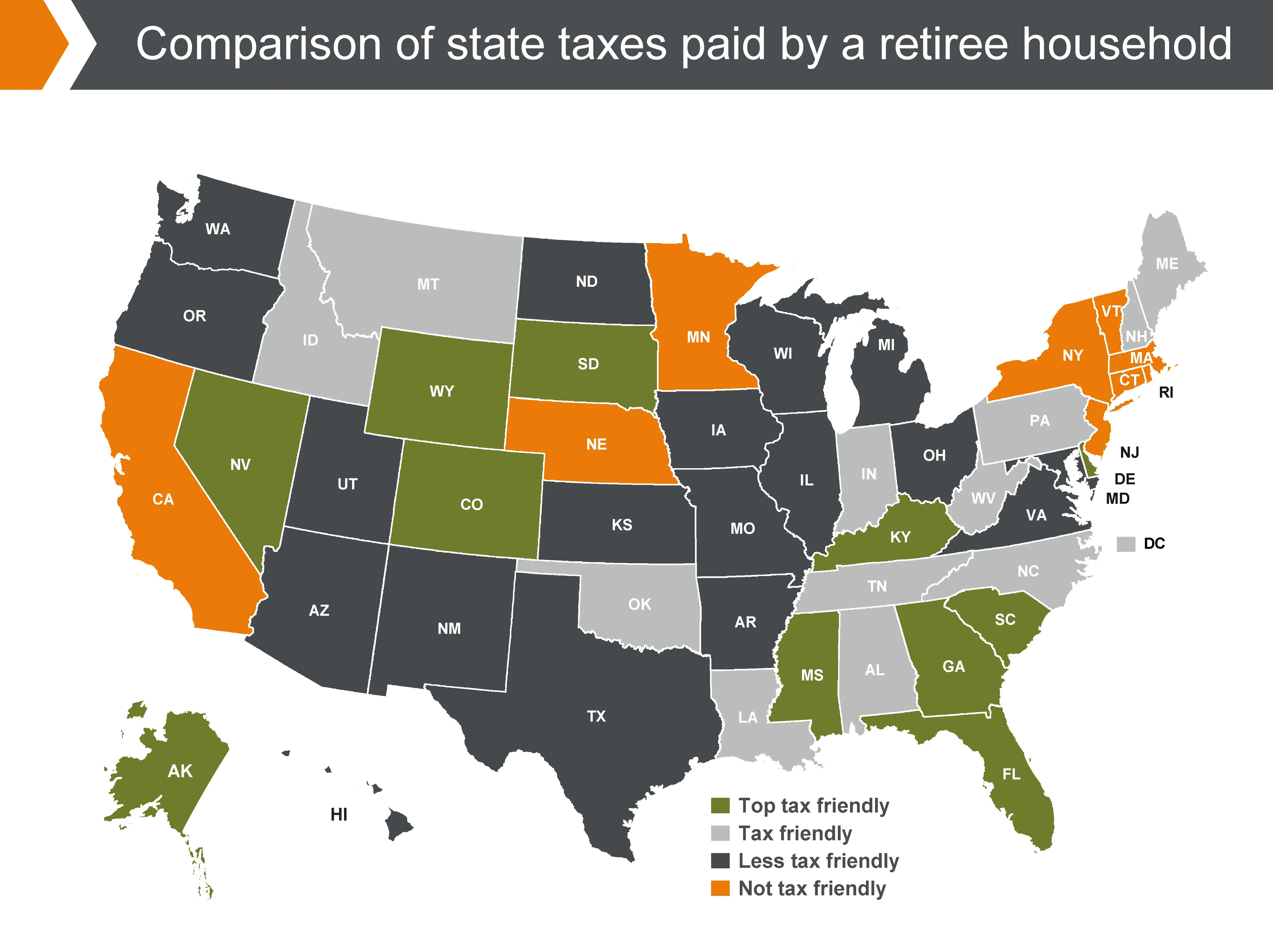

Low taxes and great place to live.

. Retirement income tax breaks start at age 55 and increase at age 65. The state is phasing in a military retirement income deduction over four years. Wyoming Wyoming is unique in that it doesnt tax any income including retirement and social security.

Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments. Texas No income tax super low cost of living and warm weather. This year Florida again takes the top spot as the best state for retirement.

In order to determine the best and worst states for military retirement WalletHub compared the 50 states and the District of Columbia across three key dimensions. The Cost To Retire in Americas Sunniest Cities. State tax rates and rules for income sales property estate and other taxes that impact retirees.

Taxes on Retirement Benefits Vary From State to State. 1 Economic Environment 2 Quality of Life and 3 Health Care. 15000 from Social Security 30000 from 401k and IRA distributions and 15000 from working part-time.

Nevada No income tax low cost of living and warm weather. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. State Retirement Guides Gulf Coast Retirement.

The remaining three Illinois Mississippi. For more information about the income tax in these states visit the Arizona and Nevada income tax pages. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming.

The unemployment rate is the same at 49. If you want to know more about the pros and cons of. The average home price is a different story in Phoenix it is 240000 while in Las Vegas it is almost 275000.

Arizona Low state income tax low cost of living and warm weather. At one time or another pretty much everyone approaching retirement or early in retirement. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state income taxes at all.

States With No Income Tax Eight states dont impose an income tax on earned income as of 2021. Twenty-one percent of the population is over the age of 65 and state parkland is abundant. Lets assume youre 65 years of age earning 60000 a year.

Arizona is next with no tax on Social Security and the lowest income tax although the highest property tax rate. Arizonas income tax rate runs between 259 and 450 and this unfortunately includes retirement income. Average property tax 607 per 100000 of assessed value 2.

Flat 463 income tax rate. Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if youre retired or youre about to retire. Read this guide to learn ways to avoid running out of money in retirement.

Retiring in Nevada comes with pros and cons. Property tax exemption for seniors 65 and older or surviving spouses 50 of first 200000 in actual value exempt No estate or inheritance tax. From a tax standpoint for retirees Nevada is the best choice since it has no income tax.

We evaluated those dimensions using 30 relevant metrics which are listed below with their corresponding weights. For income taxes in all fifty states see the income tax by state. However they also have to deal with a high cost of living relatively high crime and poor healthcare.

The exemption increase will take place starting in January 2021. A lack of tax. This tool compares the tax brackets for single individuals in each state.

Increased the exemption on income from the state teachers retirement system from 25 to 50. Distributions from retirement savings accounts like a 401 k or IRA are taxed as regular income although incomes from pensions are eligible for deductions. The median income is almost the same around 52000 with Nevada in a slight advantage.

This change started rolling out in. Youll find senior communities and activities plentiful in Florida. Sun Tax-friendly and a Lower Coast of Living.

Nevada No income tax low cost of living and warm weather. Use this tool to compare the state income taxes in Arizona and Nevada or any other pair of states. Arizona State Taxes 2022 Tax Season Forbes Advisor Use this tool to compare the state income taxes in Arizona and Colorado or any other pair of states.

However Arizona does charge state income tax as well as taxes on most retirement sources such as 401ks and IRAs hence the moderate tax-friendly label. However there are a few places that are more expensive like Kingsbury and Gardnerville.

Kiplinger Tax Map Retirement Tax Income Tax

Tax Friendly States For Retirees Best Places To Pay The Least

Is It Better To Retire In Arizona Or Nevada Senior Living Headquarters

States With The Highest And Lowest Taxes For Retirees Money

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Arizona Retirement Tax Friendliness Smartasset

Arizona Retirement Tax Friendliness Smartasset

Reasons To Move From Ca To Az Prescott California Best Places To Retire

Arizona Vs Nevada Where S Better To Retire

Best Places To Retire In Each State 2018 Page 6 Forbes Norma Jean Gargasz Alamy 96 Arizona Rank Best City Best Places To Retire Places Places To Go

37 States That Don T Tax Social Security Benefits The Motley Fool

Arizona State Taxes 2022 Tax Season Forbes Advisor

States With Highest And Lowest Sales Tax Rates

Leaving California Best Places To Retire Cost Of Living Prescott

These Are The Top 10 States That People Are Moving To Retirement Locations States Business Insider

Arizona Vs Nevada Where S Better To Retire

10 States That Attract The Most Retirees Voting With Their Feet Best Places To Move Best Places To Retire Retirement

Tax Friendly States For Retirees Best Places To Pay The Least